Why you shouldn’t get your Financial Advice from Social Media.

As some of you may know, I am a financial adviser and I often see some pretty horrible financial advice or financial observations. The…

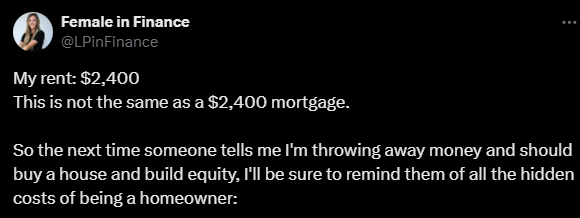

As some of you may know, I am a financial adviser and I often see some pretty horrible financial advice or financial observations. The recent one has been this tweet from Females in Finance.

Before we continue, I have not considered any of your personal circumstances and this is not financial advice.

The premise is correct but the advice is terrible. Yes, my $2,400 mortgage is not the same as your $2,400 rent. My $2,400 mortgage increases the equity that I have in a property. Your $2,400 rent doesn’t. Let’s expand this, shall we?

Why is my $2,400 mortgage more than your $2,400 rent?

So, the author lists a variety of costs that a homeowner may have to pay that a renter doesn’t.

— Private mortgage insurance

— Homeowner’s insurance

— Property taxes

— HOA fees

— Water & trash

— Maintenance

— The downpayment that could have been invested

— Closing costs

— Emergency costs

Firstly

A person renting the property will most likely pay for water, electricity or anything that they will use. Your rent will not include that.

Secondly

Any maintenance that the landlord is not responsible for will be paid by the person renting. I’m from Western Australia, you can find the landlord’s obligations here.

Thirdly

The property that you buy is a psuedo-investment. Any downpayment is effectively an investment in the property market. You can use this equity onwards to acquire further property or acquire a margin lending account. With rent, you lose that money to the Landlord’s pockets.

There is an example of this even in her own tweets. Her landlord bought the property at $500,000 (valued at $1.1 million). This means that her landlord received $120,000 per year of equity. This is equity that they can utilise for future investments. A renter cannot do this.

Fourthly

The landlord would have considered all costs before renting the property out to you. People don’t charge rent just to repay their mortgage that they have out on their property. They also charge a bit extra to cover all of those costs that potentially could occur on their end.

If those costs rise substantially, you can bet at rent review that your rent will be increased.

This tweet is absolutely false in the sense that it is the minimum that they would pay. They would already be paying some of the costs within the rent itself and they would most likely be paying for water/electrcity. They’re already paying close to what a homeowner would be paying!

Fifthly

The long-term performance is what matters the most.

Your landlord has received a 100% return in the last 5 years and earned income. You probably received a return of 85% (S&P 500 for the last 5 years) and paying a portion of that to your landlord.

In a scenario of a homeowner, they would have acquired additional 100% on their equity and paid down the mortgage for further equity. They can utilise this to purchase their own share portfolio and compound the gains if they wished.

You as the renter are unable to do this, You will continue to get your 85% return and pay rent/expenses to your landlord. You do not have the freedom to invest it into a different product if you wanted to.

Sixthly

The conversation was warped from $2,400 rent v $2,400 mortgage to $2,400 rent to $8,377 mortgage. Of course, this isn’t the same and you would most likely be throwing your money away if you bought it.

You’d be essentially making a bet that your property would appreciate by 3x the amount over a 30 year period. Based on California’s average house price over the last 30 years, it would not be a good idea. I agree that it would be just better to rent.

However, your initial premise was that a $2,400 rent was more than $2,400 in mortgage. If we use your initial premise, you should buy the property. As I said in my 5th point, you would be 15% ahead and receiving rental compared to being only 85% ahead and paying a part of it as rent.

Lastly

I felt that this tweet wanted to highlight something but wasn’t great at communicating it. There are exceptions to the rule in each market but that doesn’t mean that we should change everything because there is an exception.

You take advantage of the exception but you don’t change your entire strategy to fit that exception.

If this tweet highlighted that $2,400 rent v $8,377 mortgage at the start then none of this would have happened.

Questioning people’s reading comprehension when you subtly flip the conversation isn’t their issue. It is your issue in communicating it.